Is it time to review how you pay your salary as a director?

Following the 2025 autumn statement, the changes announced by the chancellor could affect how owners of limited companies should pay themselves.

The tried and tested method of low salaries topped up with dividends may not now be the best approach.

For the 2025/26 tax year in the UK, the income tax rates are as follows:

0% on income up to £12'570 (personal allowance)

20% on income from £12'571 to £50'270 (basic rate), 40% on income from £50'271 to £125'140 (higher rate)

and 45% on income over £125'140 (additional rate)

These rates apply in England, Wales, and Northern Ireland; Scotland has different rates.

The dividend tax rate will rise from 2026 to:

10.75% (basic)

35.75% (higher)

39.35% (additional)

On first calculation, dividends become slightly more expensive than salary, meaning extraction strategies for small companies need revisiting.

Savings & property income also moves into a new regime from 2027, with standalone rates of 22% / 42% / 47%.

Income is now taxed in a new order too: non-property → property → savings/dividends. Non-residents lose their notional tax credit.

For many landlords, the numbers will no longer stack. For directors, the mix of salary/dividends/pensions needs a fresh look.

There's no default answer anymore.

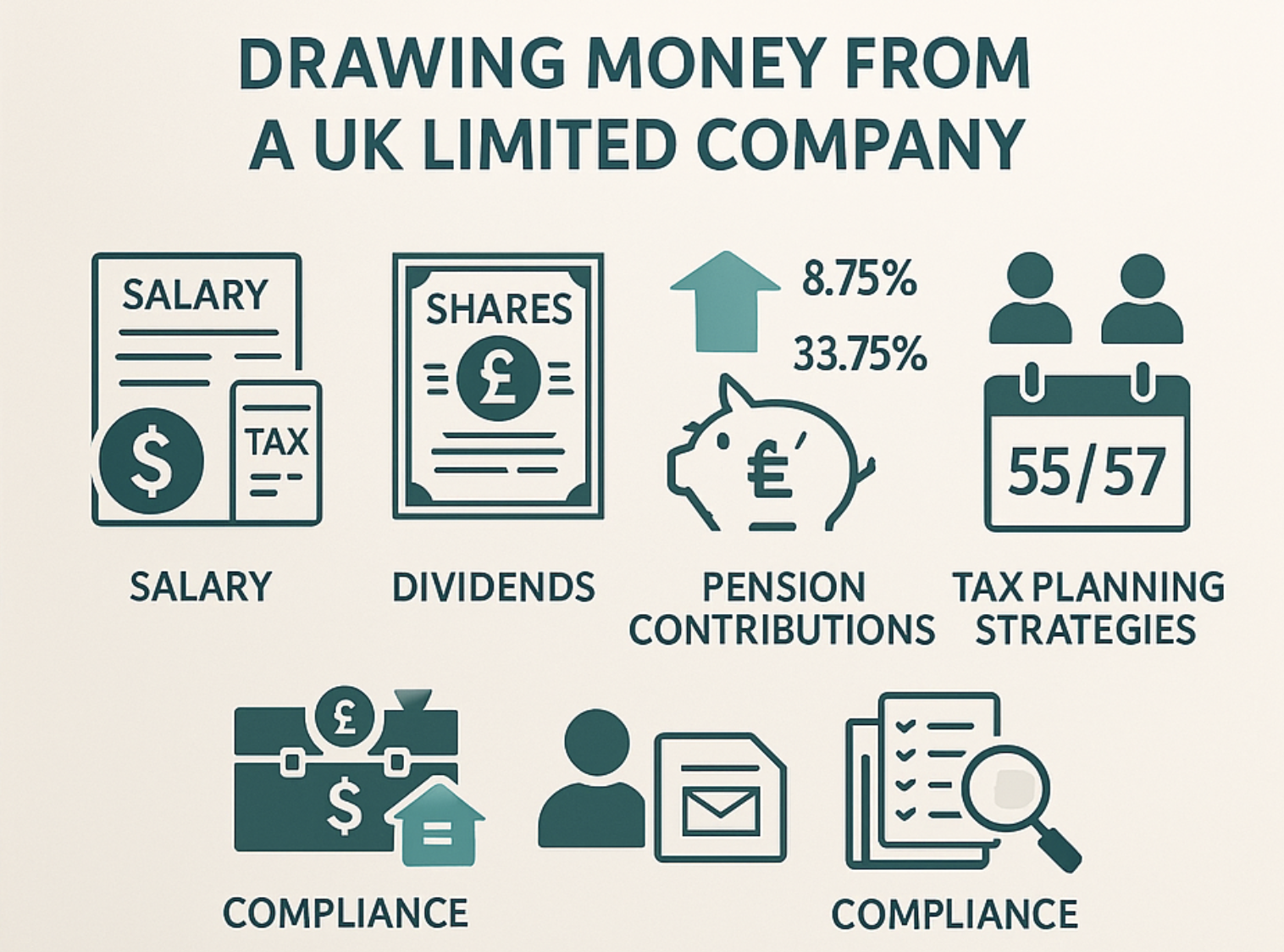

There are a number of ways to readdress the way in which money is drawn from the company:

Pay family members

- Pay your spouse up to the £12'750 personal tax allowance.

Make them a shareholder and utilise the £500 dividend allowance.

By having more than yourself on the payroll and using the employment allowance, the Nics could be offset.

Delay the dividend payment

Delay the dividend, don't take the money until it's required as tax is due on paid dividends. Utilise the proposed dividend nominal account. By paying a salary/dividend mix up to £50'270 (basic rate), the higher tax rate can be avoided for both dividends and salary.

£37'520 + £12'850 pre-April = (basic rate tax) + £37'520 + £12'850 post-April = (basic rate tax) = £100'540 in a year at basic rate tax.

Pension payments

Use your company to contribute to your pension, especially if you're in the 25% corporation tax band.

This is beneficial as pension contributions, like salary, are an allowable expense (dividends are not)

You can contribute up to £60'000 per year

You'll be extracting cash from the business

Building future wealth

Saving in corporation tax

The catch is, you can't access your pension fund until you're 55 or 57 from 2028.

To do this you must;

Be registered for PAYE and submit the RTI via recognised software like Sage payroll

You must submit actual payslips and FPS

Dividends must be declared and vouchers created

Before filing the year end accounts dividends must be;

Declared by the company in board member accounts

Backed up by available post tax profits

Documented with dividend vouchers

You do not need to send this to HMRC, however, keep the paperwork on file and declare the dividend in your self assessment.

This seems obvious but make sure the tax is paid or you'll receive a penalty.

Perform a year end internal audit to make sure everything is correct.