The autumn statement will have an impact on many people.

Chancellor Rachel Reeves has unveiled her Budget, but key details were leaked ahead of time by the official forecaster.

The UK economy is now forecast to grow by an average of 1.5% this year, surpassing the 1% growth projected by the Office for Budget Responsibility in March. However, forecasts for the next four years have been downgraded, with gross domestic product expected to increase by 1.4% next year, down from the March forecast of 1.6%.

Key points from this year's budget include:

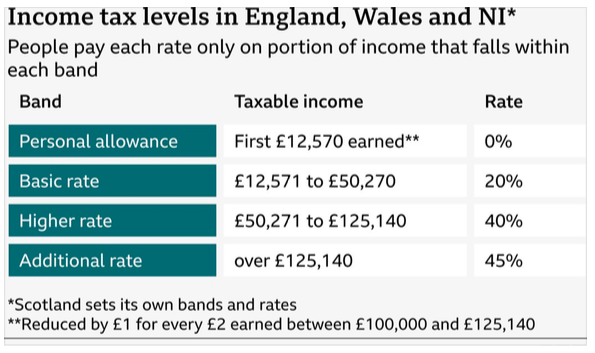

The tax thresholds will remain frozen until 2031, a three-year extension from the original plan.

Despite the inflation rate dropping for the first time in seven months to 3.6% in the year to October, working people have effectively experienced a pay cut due to the freeze in the personal tax allowance. Food price inflation has risen, with average prices 4.9% higher than last October.

This measure also means a pay rise could push an individual into a higher tax bracket.

The Chancellor confirmed increases in April for those on minimum wages.

This means:

Eligible workers aged 21 and over on the National Living Wage will earn £12.71 per hour, up from £12.21.

Those aged 18, 19 or 20 will see their National Minimum Wage increase to £10.85 per hour, up from £10.00.

For those aged 16 or 17, the minimum wage will rise to £8 per hour, up from £7.55.

The separate apprentice rate for those under 19 (or those over 19 in their first year of an apprenticeship) will also increase to £8 per hour, from £7.55.

Vehicles

Electric vehicle and hybrid car drivers will face a road tax from 2028; electric

car drivers will pay 3p per mile, while plug-in hybrid drivers will pay 1.5p per mile.

These rates will increase annually in line with inflation, although the government has not provided details on how this will be implemented.

The 5p 'temporary' reduction in fuel duty on petrol and diesel will be extended from April and then gradually increased from September 2026.

Traveling

Regulated rail fares in England will remain frozen until March 2027.

Housing

From April 2028, anyone living in a home valued at £2 million or more in England will face a council tax surcharge.

Savings

The annual tax-free savings limit in a cash ISA (Individual Savings Account) for those under 65 will be reduced from £20,000 to £12,000. Ministers want people to invest more in stock-related products, which come with increased risk.

Starting April 2027, there will be a two percentage point increase to the basic,

higher and additional rates of savings income tax. These rates will rise to 22%,42%, and 47% respectively. This means basic-rate taxpayers earning more than £1,000 in interest annually will pay 22% in savings tax, while higher-rate taxpayers will pay 42% on interest earned over £500.

Business

The current Corporation Tax rate in the UK is 25% for profits exceeding £250,000. A smaller profits rate of 19% applies to profits of £50,000 or less.

From 6 April 2027, the government will create separate tax rates for property income.

The income tax rates for property income will be 22% for basic rate, 43% for higher rate, and 47% for additional rate.

From 6 April 2026, the rates for individuals will increase by 2% to 10.75% for the dividend ordinary rate and 35.75% for the dividend higher rate. The additional rate will remain unchanged at 39.35%.

From April 2029, the amount of salary that an employee can sacrifice in return for pension contributions before attracting a National Insurance contributions (NICs) charge will be capped at £2,000 a year.

The government will double the penalty for taxpayers submitting a Corporation Tax return late from 1 April 2026.

Business rates relief is being extended in targeted regions and sectors, including marine innovation and critical minerals along with the introduction of permanently lower business rates for over 750,000 retail, hospitality and leisure properties from April 2026.

A business rates increase has been announced for logistics and distribution centres.

As announced at the Autumn Budget 2024, the government is amending the benefit in kind rules so that vehicles provided through Employee Car Ownership Schemes (ECOS) will be deemed as taxable benefits. To allow more time for the sector to prepare for and adapt to this change in treatment, its implementation will be delayed to 6 April 2030, with transitional arrangements until April 2031.

Recent changes to business rates for transport and warehousing include a proposed higher multiplier for properties with a rateable value over £500,000, which is expected to increase costs for large distribution warehouses.

A number of measures relating to capital allowances have been announced, including maintaining the full expensing for plant and machinery in the year of expenditure.A new 40% first-year allowance will be introduced from 1 January 2026, which should have the advantage of covering assets used for leasing, albeit some minor exclusions will remain.

Capital Gains Tax Employee Ownership Trusts

The government will reduce the Capital Gains Tax relief available on qualifying disposals to Employee Ownership Trusts from 100% of the gain to 50%. This will take effect from 26 November 2025.

Benefits

The two-child cap will be abolished in April next year.

Several benefits, including all main disability benefits such as the Personal Independence Payment, Attendance Allowance, and Disability Living Allowance, will rise by 3.8% in April to match rising prices.

Disabled people using the Motability scheme for a car will no longer be eligible for premium vehicles.

The state pension will also increase by 4.8% in April in line with average wages.

This rise comes with a caveat that some pensioners will be subject to income tax.

Other

The UK tax on fizzy drinks will extend to milk-based products in 2028.

The cost of a single NHS prescription in England will remain frozen at £9.90.

England's mayors may gain the authority to impose a levy on overnight stays.

Alcohol duty will increase in line with retail price inflation from February. Additionally, a flat-rate excise duty of £2.20 per 10ml on all vaping liquids will be introduced from October 1 next year.

Remote gambling duties on online casinos will rise to 40% from 21% from 2026.

What do you make of the budget? With today's tax hikes, it is forecast to raise £26.1bn by 2029/30, building on the £40bn raised back in October 2024.

Are you a budget winner or loser?

As for the markets, the FT100 closed up 0.02% while UK government bonds rallied on Wednesday after an accidental leak from the Office for Budget

Responsibility revealed Chancellor Rachel Reeves will end up with a £22bn fiscal headroom.