Understanding Your Income Statement

Understanding Your Income Statement and Profit & Loss

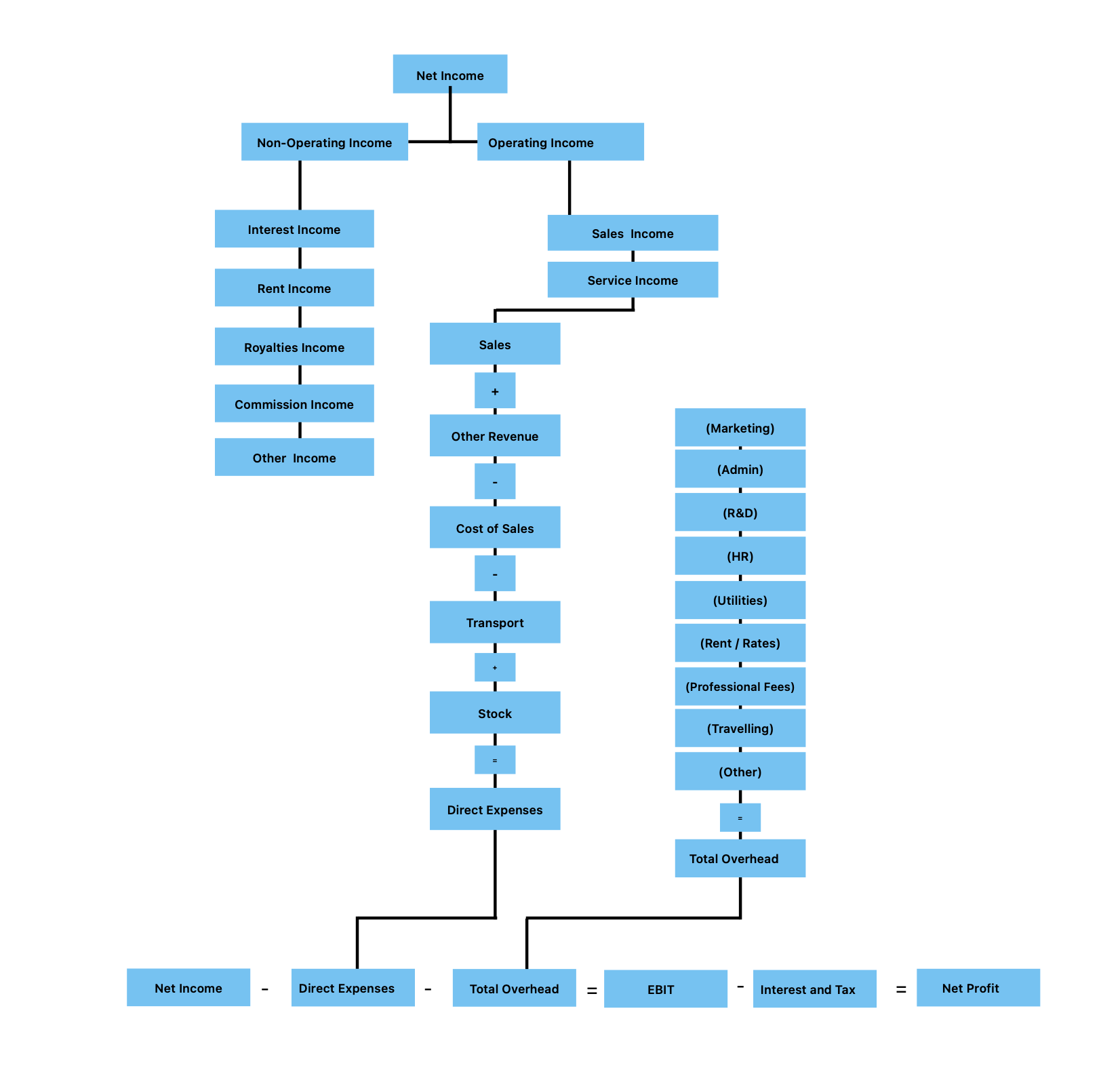

Many business owners glance at their income statement each month but don't always understand the story behind the numbers. Your Profit & Loss (P&L) statement is more than just figures – it's a roadmap for your business performance.

Here's how to break it down:

Revenue (Top Line)

This is all the income generated by your business before any expenses. Tracking trends here shows whether your sales strategies are working.

Cost of Goods Sold (COGS)

These are the direct costs related to producing your product or service. Reducing COGS without compromising quality can increase your margins.

Gross Profit

Revenue minus COGS gives you the gross profit – it shows how efficiently you turn income into profit before overheads.

To calculate net profit margin, use the formula: Gross Profit Margin = (Revenue - COGS) / Revenue] x 100

Operating Expenses or Overhead

This includes salaries, rent, utilities, marketing, and other day-to-day costs. Keeping these under control helps protect your profit.

Operating Profit or Earnings Before Interest and Tax (EBIT)

After operating expenses, you'll see your true operating profit. This reflects the core health of your business operations.

Net Profit (Bottom Line)

After accounting for taxes, interest, and other non-operating costs, this is what remains. This figure determines your real profitability.

To calculate net profit margin, use the formula: Net Profit Margin=(Net profit/Sales Revenue) x 100 This shows the percentage of revenue that remains as profit

Tip: Regularly comparing P&L statements over time helps spot trends, inefficiencies, and opportunities for growth.

Understanding your P&L statement empowers you to make informed decisions and drive your business forward with confidence.